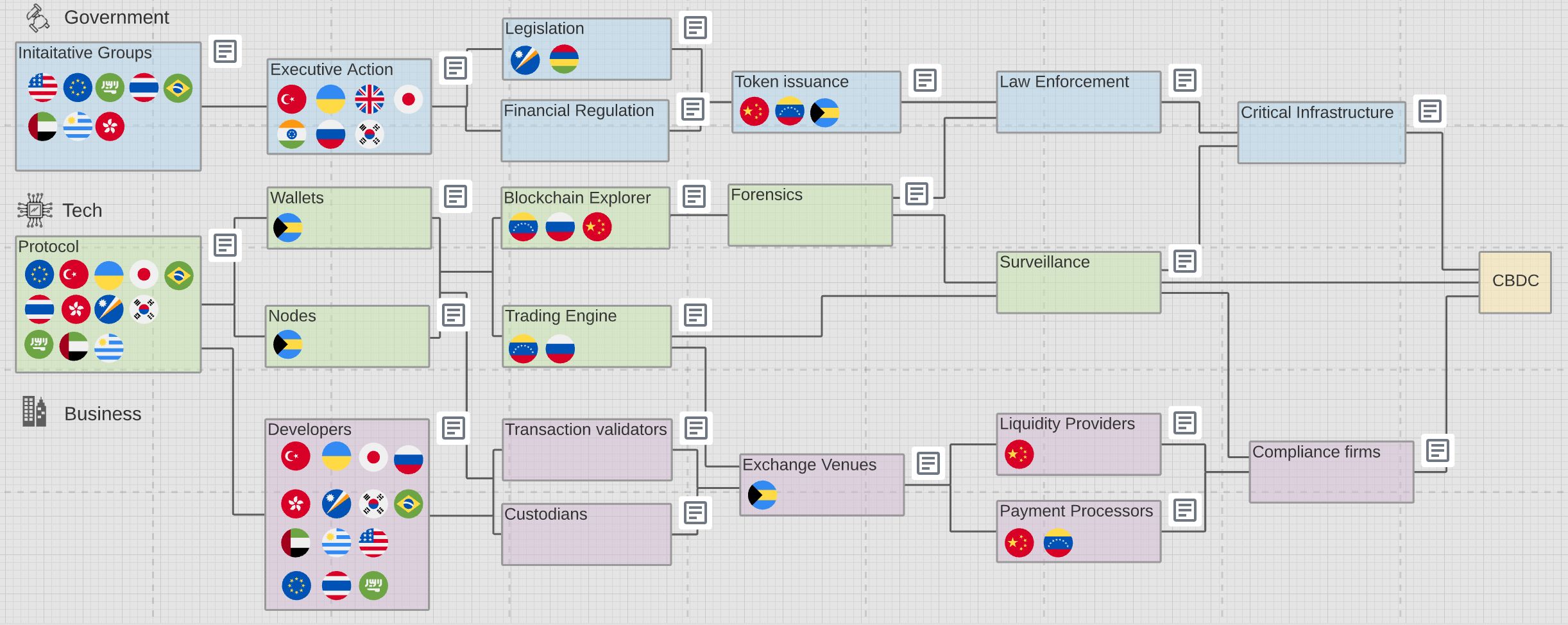

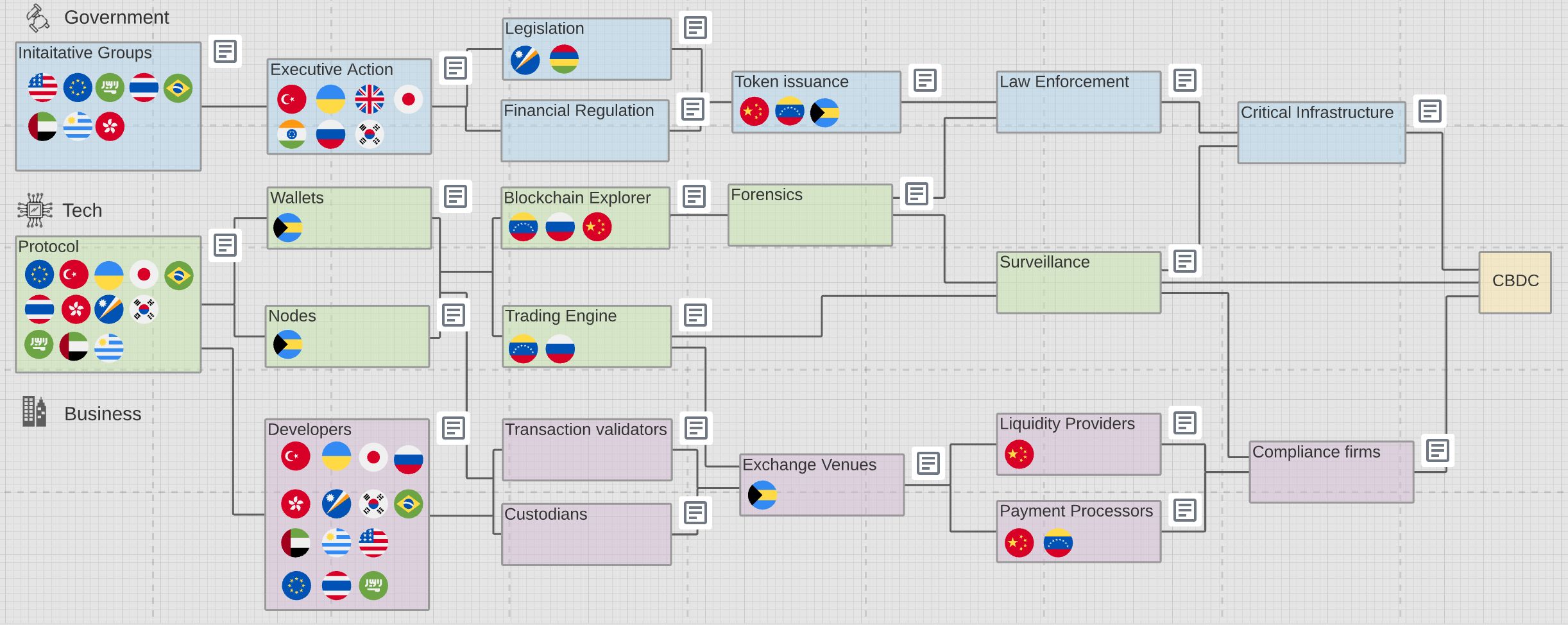

Government's around the world are preparing to roll out their respective CBDCs. It's important to understand some of the risks associated with this development

Government's around the world are preparing to roll out their respective CBDCs. It's important to understand some of the risks associated with this development

For now, of course, we'll be content with what we have, but we have quite a lot compared to the previous crypto winter, heh! Invest wisely! Diversify all risks!

For now, of course, we'll be content with what we have, but we have quite a lot compared to the previous crypto winter, heh! Invest wisely! Diversify all risks!

Comparatively to traditional cryptocurrencies, a CBDC is centralized, and thus it is regulated by the issuing organization or country.

Comparatively to traditional cryptocurrencies, a CBDC is centralized, and thus it is regulated by the issuing organization or country.

dappOS aims to unite the many chains into a single experience for the Web3 novice to access decentralized applications.

dappOS aims to unite the many chains into a single experience for the Web3 novice to access decentralized applications.

Monitoring recognizable brands as they move into web3

Monitoring recognizable brands as they move into web3

Learn the risks that Central bank digital currencies (CBDCs) pose to your monetary freedom and privacy.

Learn the risks that Central bank digital currencies (CBDCs) pose to your monetary freedom and privacy.

While the bitcoin community seems fully absorbed by the daily ups and ATHs of bitcoin, it seems that most people have missed what might well be the biggest and most impactful news of the year 2021 for the crypto sector.

While the bitcoin community seems fully absorbed by the daily ups and ATHs of bitcoin, it seems that most people have missed what might well be the biggest and most impactful news of the year 2021 for the crypto sector.

To paraphrase John K. Galbraith, while many concepts that relate money, venture into the arcane, others, such as CBDCs are so simple that “the mind is repelled”

To paraphrase John K. Galbraith, while many concepts that relate money, venture into the arcane, others, such as CBDCs are so simple that “the mind is repelled”

Thoughts on the US Federal Reserve's CBDC paper and request for comments from the writer of the Digital Universal Drachma white paper.

Thoughts on the US Federal Reserve's CBDC paper and request for comments from the writer of the Digital Universal Drachma white paper.

The utilization of the "speed wallet" concept offers a temporary solution on the path to true CBDC implementation that central banks must examine closely.

The utilization of the "speed wallet" concept offers a temporary solution on the path to true CBDC implementation that central banks must examine closely.

It is hard to believe that soon banks will lose their hegemony, but the process is happening and cryptocurrency is a big part of the reason

It is hard to believe that soon banks will lose their hegemony, but the process is happening and cryptocurrency is a big part of the reason

Dubai's DubaiCoin, $DBIX, is a new central bank digital currency

Dubai's DubaiCoin, $DBIX, is a new central bank digital currency

Will CBDCs replace cryptocurrency? Will Soulbound tokens - as touted by Vitalik Buterin- help to overcome some of NFTs’ challenges? Let’s take a deep dive in!

Will CBDCs replace cryptocurrency? Will Soulbound tokens - as touted by Vitalik Buterin- help to overcome some of NFTs’ challenges? Let’s take a deep dive in!

Central bank digital currencies (CBDCs) have been in the rumors since 2013, with China allegedly developing in secrecy a government-issued centralized cryptocurrency to fight off the increasingly popular Bitcoin. But it wasn’t until September 2015 when the Bank of England had publicly discussed for the first time the use of a blockchain-based central bank currency as a way to implement negative interest rates, and March 2016 when the phrase “central bank digital currency” had been coined.

Central bank digital currencies (CBDCs) have been in the rumors since 2013, with China allegedly developing in secrecy a government-issued centralized cryptocurrency to fight off the increasingly popular Bitcoin. But it wasn’t until September 2015 when the Bank of England had publicly discussed for the first time the use of a blockchain-based central bank currency as a way to implement negative interest rates, and March 2016 when the phrase “central bank digital currency” had been coined.

Fintech development in China has consistently experienced tremendous scale in the last two decades, but recent legislative measures aim to curb this growth.

Fintech development in China has consistently experienced tremendous scale in the last two decades, but recent legislative measures aim to curb this growth.

Over the last decade, the monetary policies of Central Banks haven't helped much the global economy and all have failed to meet their targets. Since the global financial crisis of 2008, Central Banks like the ECB have neither succeed to meet their inflation targets nor to restore the economic activity. Central Banks have also failed to innovate and adopt new technologies and systems that may solve many issues. However, the last few months this has changed as they have started to examine the new technologies like DLT or blockchain.

Over the last decade, the monetary policies of Central Banks haven't helped much the global economy and all have failed to meet their targets. Since the global financial crisis of 2008, Central Banks like the ECB have neither succeed to meet their inflation targets nor to restore the economic activity. Central Banks have also failed to innovate and adopt new technologies and systems that may solve many issues. However, the last few months this has changed as they have started to examine the new technologies like DLT or blockchain.

ECCB's Dcash outage provides central bankers, governments, &technology providers with the opportunity to reflect on the challenges emerging from CBDC failures.

ECCB's Dcash outage provides central bankers, governments, &technology providers with the opportunity to reflect on the challenges emerging from CBDC failures.

CBDCs may be able to help bring stability to the Israeli-Palestinian conflict by acting as a mutually-trusted system for all groups to transact with each other.

CBDCs may be able to help bring stability to the Israeli-Palestinian conflict by acting as a mutually-trusted system for all groups to transact with each other.

Programmability is a key feature of CBDC, meaning central banks and their customers could have total control over when, where, and how the money is spent.

Programmability is a key feature of CBDC, meaning central banks and their customers could have total control over when, where, and how the money is spent.

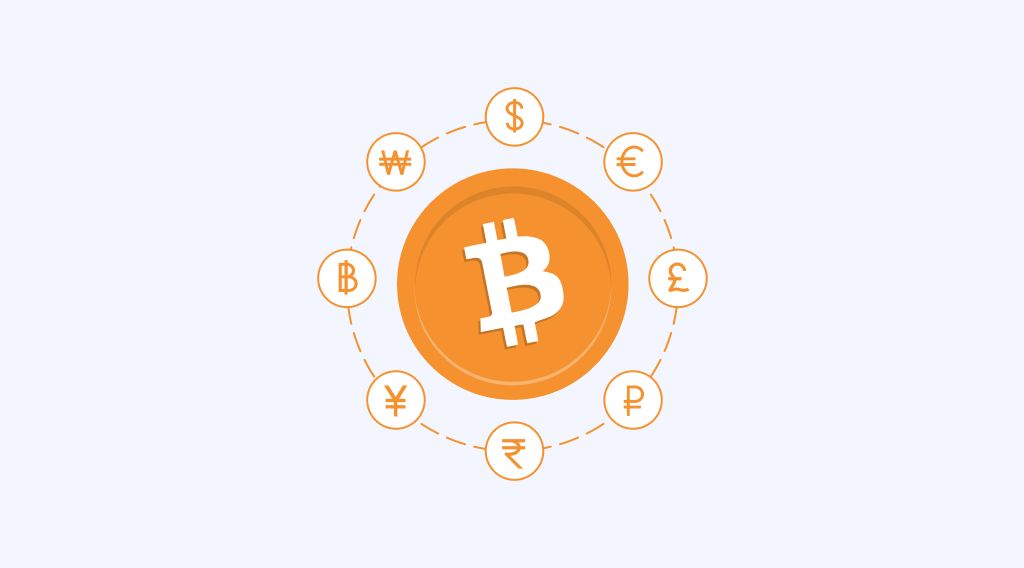

Bitcoin and Central Bank Digital Currencies - CBDC. What is the future of the dollar and money we know? Can Bitcoin change the way we think of the money?

Bitcoin and Central Bank Digital Currencies - CBDC. What is the future of the dollar and money we know? Can Bitcoin change the way we think of the money?

Let's look at some exciting developments in the blockchain industry this year.

Let's look at some exciting developments in the blockchain industry this year.

The current outbreak of coronavirus disease has significantly accelerated the development of central banks digital currencies (CBDC). It is easy to check with the growing number of projects and the recent first official launch of digital currency in the Bahamas. Moreover, Deutsche Bank analysts say that in the long term, CBDC can replace cash.

The current outbreak of coronavirus disease has significantly accelerated the development of central banks digital currencies (CBDC). It is easy to check with the growing number of projects and the recent first official launch of digital currency in the Bahamas. Moreover, Deutsche Bank analysts say that in the long term, CBDC can replace cash.

The ECB (European Central Bank) has published a report stating

the digital euro is getting closer to be launched. It gives an overview of a

possible roadmap for implementing the digital euro as well as the advantages and disadvantages of a digital currency in the euro zone.

The ECB (European Central Bank) has published a report stating

the digital euro is getting closer to be launched. It gives an overview of a

possible roadmap for implementing the digital euro as well as the advantages and disadvantages of a digital currency in the euro zone.

Stanley Wu is the Co-founder and CTO of Ankr and a longtime engineer (formerly at AWS) and a computing student.

Stanley Wu is the Co-founder and CTO of Ankr and a longtime engineer (formerly at AWS) and a computing student.

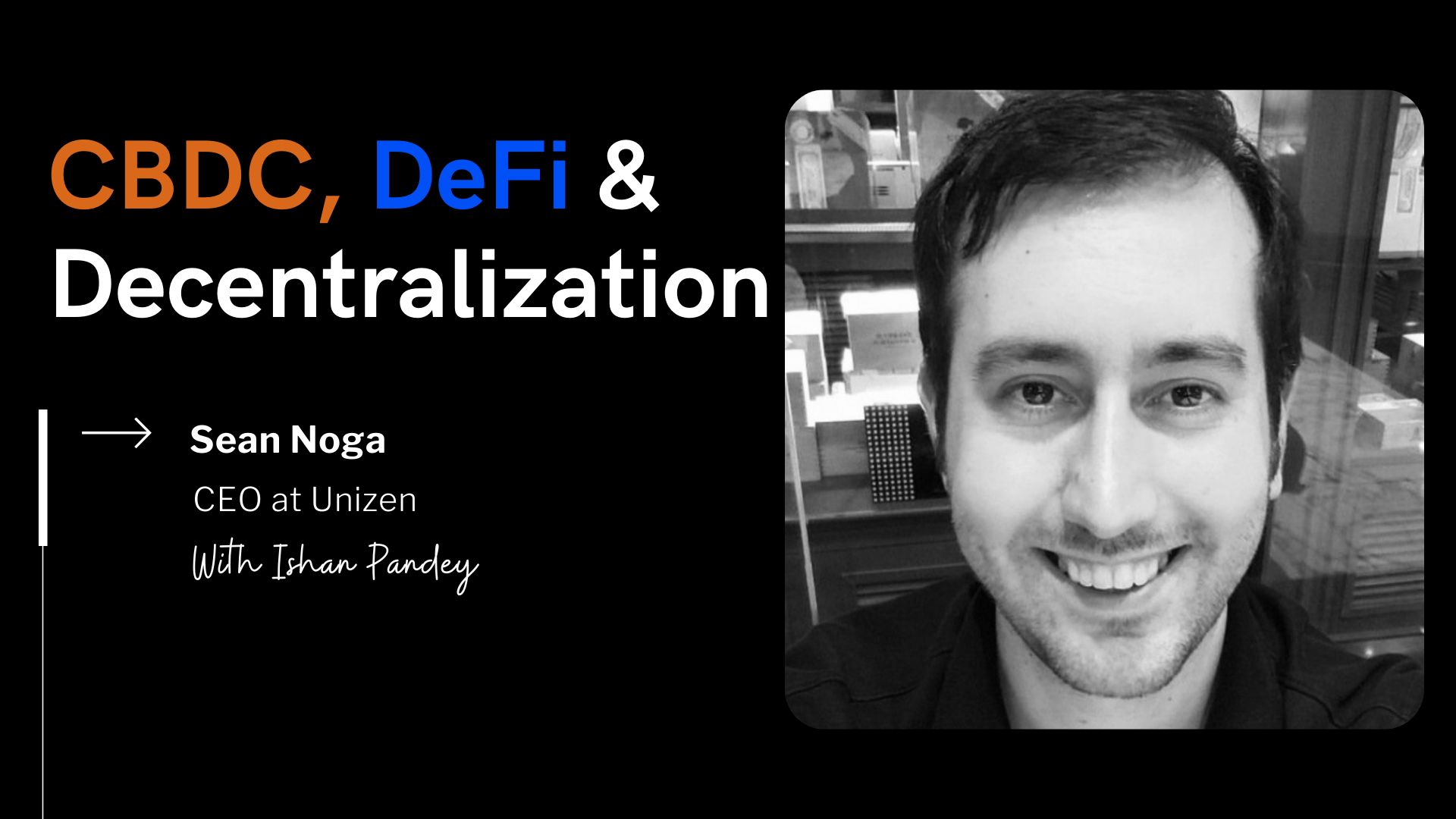

This article talks about CBDCs, DeFi and blockchain. The article discusses the digital yuan and why it won't change the world order.

This article talks about CBDCs, DeFi and blockchain. The article discusses the digital yuan and why it won't change the world order.

Chitose Nakamoto speaks about the Digital Universal Drachma, writing, philosophy, and society.

Chitose Nakamoto speaks about the Digital Universal Drachma, writing, philosophy, and society.

There is a very real possibility of the Bank of Thailand being among the first Asia-based banks to unveil a retail CBDC for use by its population and beyond.

There is a very real possibility of the Bank of Thailand being among the first Asia-based banks to unveil a retail CBDC for use by its population and beyond.

The Nakamoto Terminal CBDC Factbook is a compilation of intelligence insights on international efforts to create Central Bank Digital Currencies.

The Nakamoto Terminal CBDC Factbook is a compilation of intelligence insights on international efforts to create Central Bank Digital Currencies.

The Money Tree, which should be familiar to researchers of CBDCs, is a good tool for differentiating cryptocurrencies, traditional bank deposits and CBDCs

The Money Tree, which should be familiar to researchers of CBDCs, is a good tool for differentiating cryptocurrencies, traditional bank deposits and CBDCs

Less than 1% of the world’s population uses cryptocurrencies. And whether the remaining 99% want to use them or not, it doesn’t matter anymore.

Less than 1% of the world’s population uses cryptocurrencies. And whether the remaining 99% want to use them or not, it doesn’t matter anymore.

CBDCs could be the next big thing for governments and financial institutions.

CBDCs could be the next big thing for governments and financial institutions.

Governments must identify, discuss, and ideate their wallet choices when thinking about CBDCs, incorporating key policy considerations for true defi for all.

Governments must identify, discuss, and ideate their wallet choices when thinking about CBDCs, incorporating key policy considerations for true defi for all.

The Taliban’s return to power presents a distinct use case for cryptocurrencies and central bank digital currencies (CBDCs) alike.

The Taliban’s return to power presents a distinct use case for cryptocurrencies and central bank digital currencies (CBDCs) alike.

Looking back at the events that unfolded in 2022, it was quite obvious that regulators would take a serious stance on crypto activities sooner rather than later

Looking back at the events that unfolded in 2022, it was quite obvious that regulators would take a serious stance on crypto activities sooner rather than later

The digital yuan's impact on the world is undisputed; however, will its potential to act as a money laundering system for the PRC override its true benefits?

The digital yuan's impact on the world is undisputed; however, will its potential to act as a money laundering system for the PRC override its true benefits?

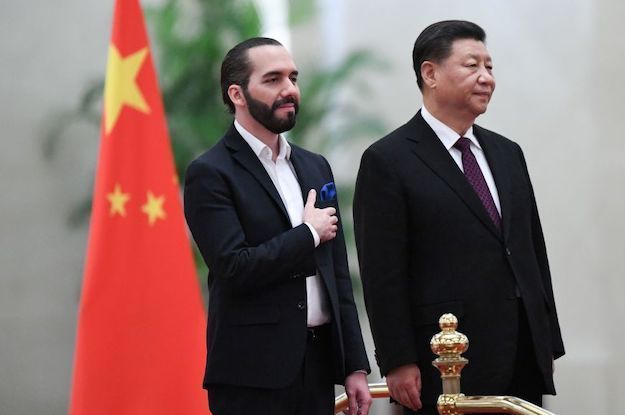

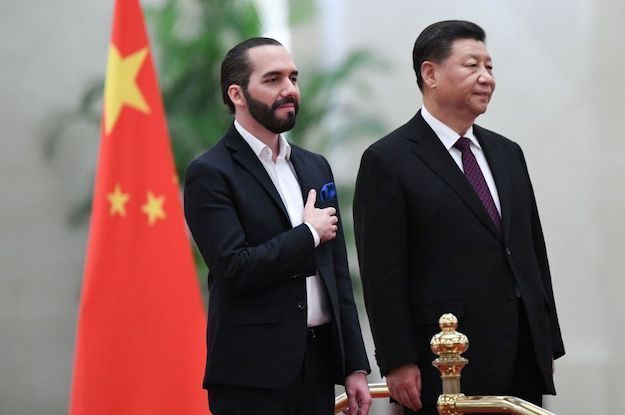

China and El Salvador's seemingly contrasting stances on digital currencies actually align both authoritarian regimes on many levels.

China and El Salvador's seemingly contrasting stances on digital currencies actually align both authoritarian regimes on many levels.

For thousands of years, CBD has been a powerful plant that has been used for the wellness of human health.

For thousands of years, CBD has been a powerful plant that has been used for the wellness of human health.

2020 was a year of unprecedented, world-changing events, some of which most people are not even aware of. Like it hasn’t been enough for one year, more news comes from China, where the government is actively testing its digital payment system called Digital Currency Electronic Payment (DCEP).

2020 was a year of unprecedented, world-changing events, some of which most people are not even aware of. Like it hasn’t been enough for one year, more news comes from China, where the government is actively testing its digital payment system called Digital Currency Electronic Payment (DCEP).

In March 2022, Joe Biden officially asked the Federal Reserve (FED) to urgently begin developing plans for a U.S. Central Bank Digital Currency (CBDC), or a so-called ‘digital dollar’. The US government is now starting to recognize the latent possibilities of the burgeoning digital asset market and hopes to use this technology to create a CBDC that will “preserve the dominant role of the U.S. dollar.” But what is a CBDC? How does it relate to cryptocurrency, and what are the latest developments in the great CBDC experiment?

In March 2022, Joe Biden officially asked the Federal Reserve (FED) to urgently begin developing plans for a U.S. Central Bank Digital Currency (CBDC), or a so-called ‘digital dollar’. The US government is now starting to recognize the latent possibilities of the burgeoning digital asset market and hopes to use this technology to create a CBDC that will “preserve the dominant role of the U.S. dollar.” But what is a CBDC? How does it relate to cryptocurrency, and what are the latest developments in the great CBDC experiment?

The adoption of cryptocurrencies as legal tender serves to guarantee some semblance of economic stability and growth for Latin American countries.

The adoption of cryptocurrencies as legal tender serves to guarantee some semblance of economic stability and growth for Latin American countries.

The day that the Italian borders were reopened after the lockdown — on June 3rd — I drove across the Brenner Pass with an overwhelming joy. I could finally rejoin my family and my old friends.

The day that the Italian borders were reopened after the lockdown — on June 3rd — I drove across the Brenner Pass with an overwhelming joy. I could finally rejoin my family and my old friends.

The Central Bank Digital Currencies (CBDC) may be pure evil, but from whose perspective? What is evil to some is pure goodness to others.

The Central Bank Digital Currencies (CBDC) may be pure evil, but from whose perspective? What is evil to some is pure goodness to others.

CBDCs are centralized digital currencies and fundamentally different from cryptocurrencies like Bitcoin. Pros, cons and oh-nos of CBDCs.

CBDCs are centralized digital currencies and fundamentally different from cryptocurrencies like Bitcoin. Pros, cons and oh-nos of CBDCs.

On October 15, Kristalina Georgieva, Managing Director of the IMF, came with an announcement talking about A New Bretton Woods Moment.

On October 15, Kristalina Georgieva, Managing Director of the IMF, came with an announcement talking about A New Bretton Woods Moment.

The PBOC's July 2021 release of a white paper highlights potential privacy issues and the disruption of China's digital payments industry by the digital yuan.

The PBOC's July 2021 release of a white paper highlights potential privacy issues and the disruption of China's digital payments industry by the digital yuan.

Bitcoin doesn't have ever-changing rules; it doesn’t inflate you away, it doesn’t require a third party, and no one can freeze or seize your funds.

Bitcoin doesn't have ever-changing rules; it doesn’t inflate you away, it doesn’t require a third party, and no one can freeze or seize your funds.

Background info about a Hackernoon Top Story author's life, interests, and career.

Background info about a Hackernoon Top Story author's life, interests, and career.

Central banks around the world are exploring the idea of issuing a variant of fiat currency that bridges the functional divide between physical cash and account-based systems.

Central banks around the world are exploring the idea of issuing a variant of fiat currency that bridges the functional divide between physical cash and account-based systems.

Central bank digital currencies are the future of money. This is the way.

Central bank digital currencies are the future of money. This is the way.

How emerging economies can lead the crypto revolution in commercial banking and enjoy an economic renaissance based on sound money

How emerging economies can lead the crypto revolution in commercial banking and enjoy an economic renaissance based on sound money

Trends in Blockchain and Cryptocurrencies are changing amazingly fast. We can express every year as the blossom of some new thing: 2017 - ICO, 2018 - IEO, 2019 - Stablecoin, 2020 - DeFi.

Trends in Blockchain and Cryptocurrencies are changing amazingly fast. We can express every year as the blossom of some new thing: 2017 - ICO, 2018 - IEO, 2019 - Stablecoin, 2020 - DeFi.

CBDC is a digital liability of a central bank that is widely available to the general public, and analogous to a digital form of paper money.

CBDC is a digital liability of a central bank that is widely available to the general public, and analogous to a digital form of paper money.

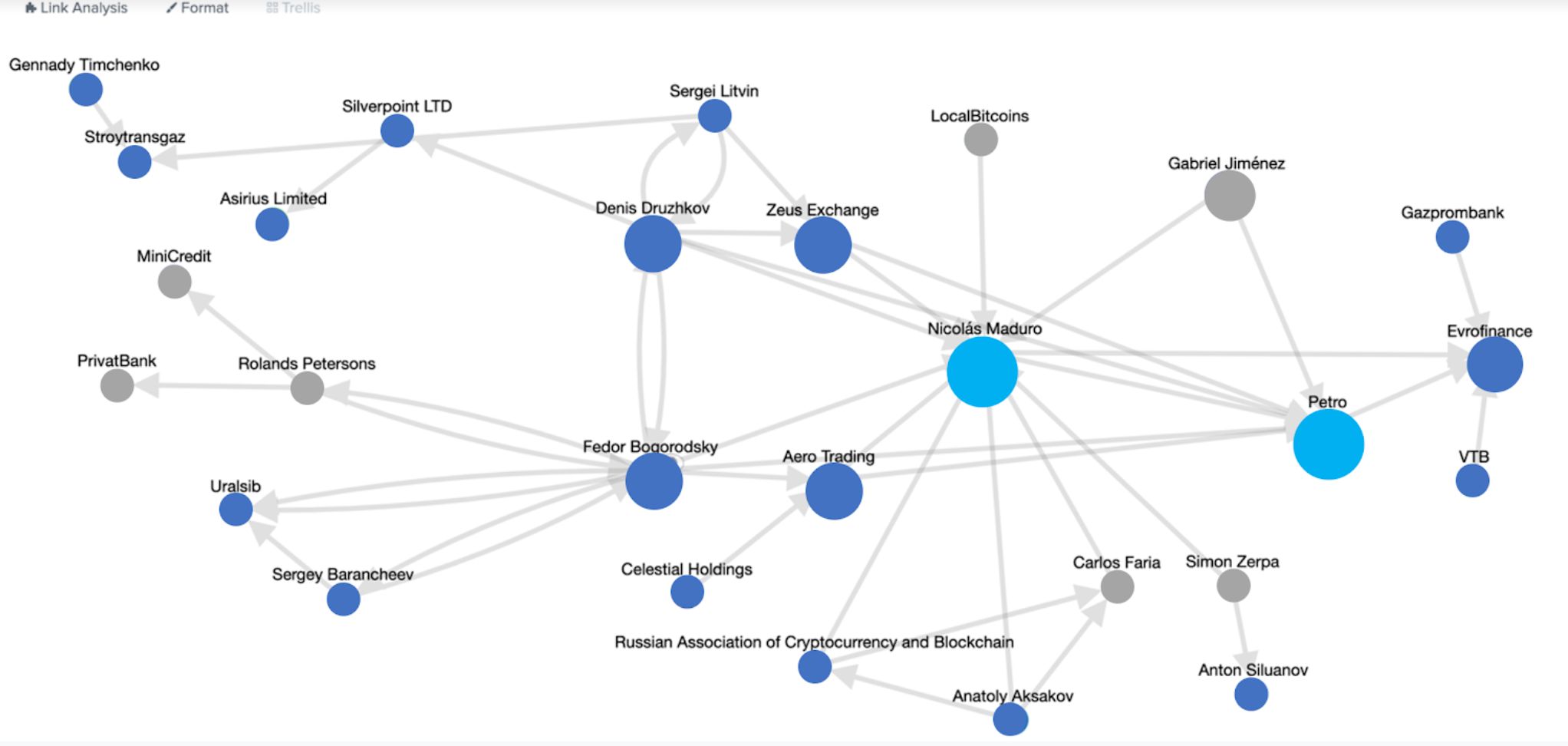

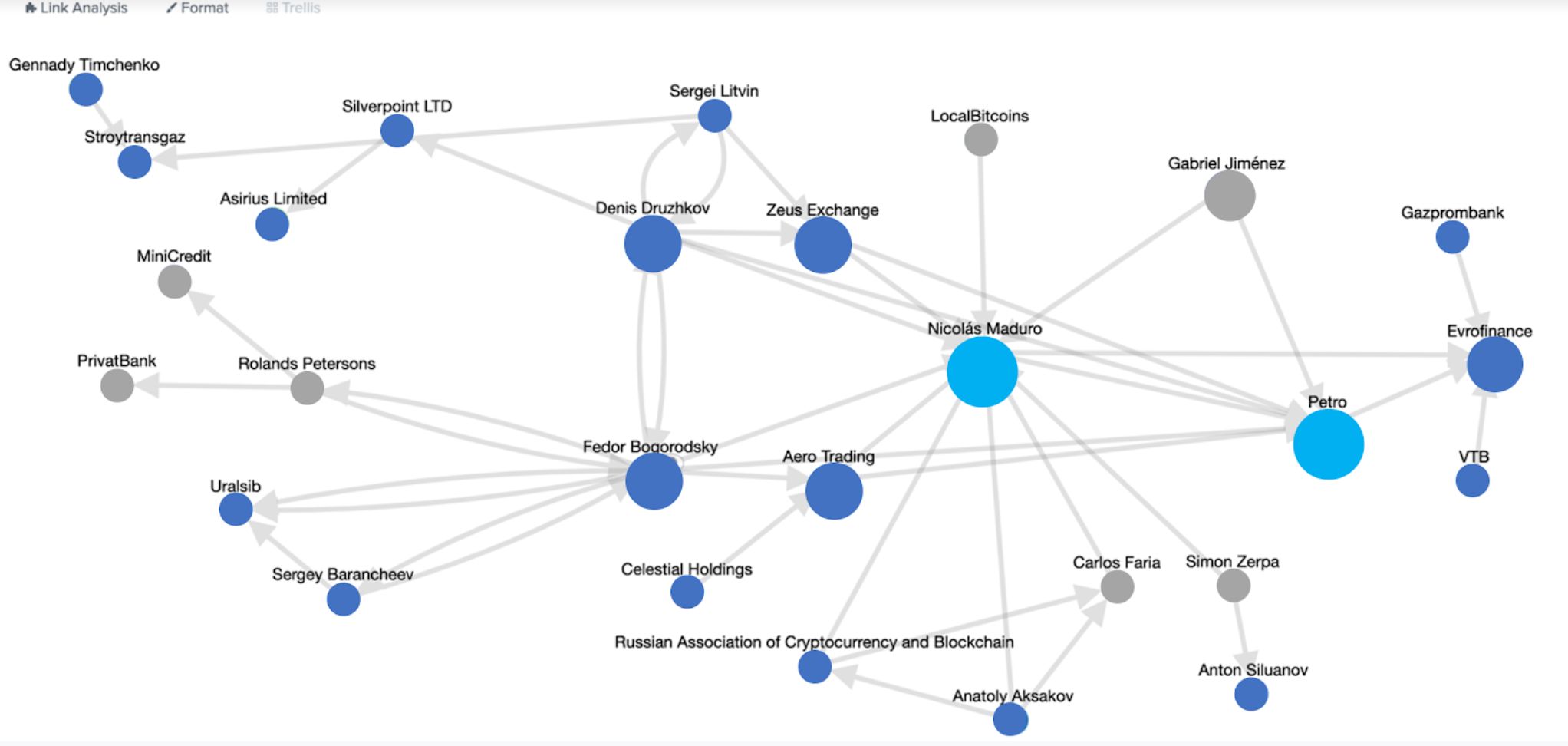

Venezuela’s Petro, also known as Petromoneda, is an allegedly oil-backed CBDC introduced in 2018.

Venezuela’s Petro, also known as Petromoneda, is an allegedly oil-backed CBDC introduced in 2018.

The PBOC's app release gives the world excellent insight into China's e-CNY ambitions, particularly with the upcoming Winter Olympics and Chinese New Year.

The PBOC's app release gives the world excellent insight into China's e-CNY ambitions, particularly with the upcoming Winter Olympics and Chinese New Year.

This article is in response to the announcement that the US is considering creating its own digital fiat currency, or "CBDC" (Central Bank Digital Currency), to improve “financial governance”.

This article is in response to the announcement that the US is considering creating its own digital fiat currency, or "CBDC" (Central Bank Digital Currency), to improve “financial governance”.

Invariably, as bitcoin spikes and defies gravity, either up or down, the attention of institutional investors, central bankers and prominent financiers is suddenly awaken.

Invariably, as bitcoin spikes and defies gravity, either up or down, the attention of institutional investors, central bankers and prominent financiers is suddenly awaken.

To evaluate a potential central bank digital currency, the Board of Governors of the Federal Reserve System published a document in January 2022 titled Money and Payments: The U.S. Dollar in the Age of Digital Transformation. The paper purports to summarize the current state of domestic payments systems, and further discuss the different types of digital payment methods and assets that have emerged in recent years, including stablecoins and other cryptocurrencies. The authors have requested feedback via an online form that poses more than twenty-two questions due by May 20th, 2022. Since meaningful responses require more than the five-thousand characters allowed by the twenty field response form - and some sections actually contain more than one question, we are publishing thoughts and observations on it here instead, while further addressing some of the shortfalls in the framing and positioning of the paper, and consequent request for comment.

To evaluate a potential central bank digital currency, the Board of Governors of the Federal Reserve System published a document in January 2022 titled Money and Payments: The U.S. Dollar in the Age of Digital Transformation. The paper purports to summarize the current state of domestic payments systems, and further discuss the different types of digital payment methods and assets that have emerged in recent years, including stablecoins and other cryptocurrencies. The authors have requested feedback via an online form that poses more than twenty-two questions due by May 20th, 2022. Since meaningful responses require more than the five-thousand characters allowed by the twenty field response form - and some sections actually contain more than one question, we are publishing thoughts and observations on it here instead, while further addressing some of the shortfalls in the framing and positioning of the paper, and consequent request for comment.

We continue to witness innovation in the FinTech sector — it seems that 2023 will equalize win-win opportunities for both consumers and financial institutions.

We continue to witness innovation in the FinTech sector — it seems that 2023 will equalize win-win opportunities for both consumers and financial institutions.